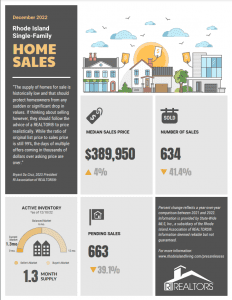

Massachusetts’ 2022 Residential Real Estate Sales Continue Steep Decline Compared to Previous Year

Median sale price growth for both single-family homes and condos started to wane at year’s end.

PEABODY, January 17, 2023 – After another month of decline in December, Massachusetts single-family home and condo sales ended 2022 down by double digits for the full year, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

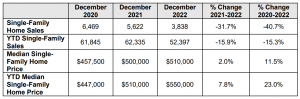

Single-Family Homes

Last month, there were 3,838 single-family home sales in Massachusetts, a 31.7 percent decrease from December 2021 when there were 5,622 transactions. This marked the fewest single-family home sales in the month of December since 2012. Meanwhile, the median single-family sale price increased just 2 percent on a year-over-year basis to $510,000, up from $500,000 in December 2021. Despite being a new all-time high for the month of December, year-over-year increases have been shrinking for the past three months.

“The Massachusetts single-family market finally hit that wall we’ve all been anticipating,” said Tim Warren, CEO of The Warren Group. “For the last few years, housing market activity has been so hot that inventory was unable to keep up – and our numbers reflect that. Add in economic uncertainties and the fact that mortgage rates are nearly double what they were a year ago, and you have the making for a cooling housing market.”

Year-to-date, there were 52,397 single-family home sales in Massachusetts in 2022, a 15.9 percent decrease from 2021. Meanwhile, the year-to-date median single-family home price increased 7.8 percent on the same basis to $550,000.

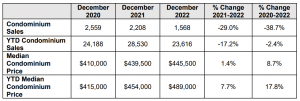

Condominiums

There were 1,568 condominium sales in December, compared to 2,208 sales in December 2021 – a 29 percent decrease on a year-over-year basis. This marked the largest year-over-year decline in 2022. Meanwhile, the median sale price increased 1.4 percent on a year-over-year basis to $445,500 – the smallest year-over-year increase recorded in 2022.

“Year-end condo market trends were in lockstep with single-family homes,” Warren added. “However, the bright side of the condo market is that there were a number of developments that broke ground in 2022 in major metro areas that will bring additional units to the market in 2023. This should provide additional options for homeownership in the near future.”

Year-to-date, there were 23,616 condo sales in 2022, a 17.2 percent decrease from 2021 with a median sale price of $489,000, a 7.7 percent increase on the same basis.

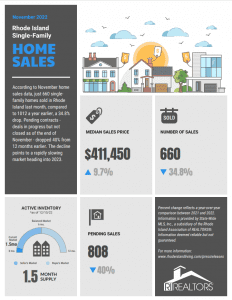

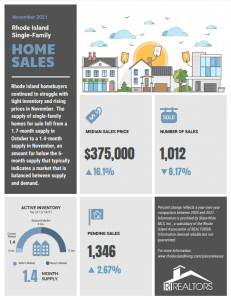

MA Single-Family Home Sales Continued to Decline in November as the Median Price Edged Higher

November single-family home sales hit an eight-year low.

PEABODY, December 21, 2022 – Massachusetts single-family homes sales declined in November on a year-over-year basis as higher interest rates, constricted inventory, and economic uncertainties continued to impact activity, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

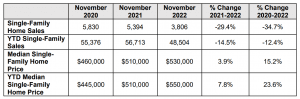

Single-Family Homes

Last month, there were 3,806 single-family home sales in Massachusetts, a 29.4 percent decrease from November 2021 when there were 5,394 transactions. This marked the fewest single-family home sales in the month of November since 2014. Meanwhile, the median single-family sale price increased 3.9 percent on a year-over-year basis to $530,000, up from $510,000 in November 2021. Despite being a new all-time high for the month of November, this was the smallest percent increase on a year-over-year basis since June 2020.

“The significant drop in single-family home sales came as no surprise in November,” said Tim Warren, CEO of The Warren Group. “A tightening inventory, higher interest rates, and economic uncertainties have had a big impact on consumer confidence, and real estate activity has taken a hit in recent months. The more important development is the slowdown in median price hikes. The 3.9 percent increase we saw in November was the smallest percent increase on a year-over-year basis since June 2020.”

Year-to-date, there have been 48,504 single-family home sales in Massachusetts, a 14.5 percent decrease from the first 11 months of 2021. Meanwhile, the year-to-date median single-family home price increased 7.8 percent on the same basis to $550,000.

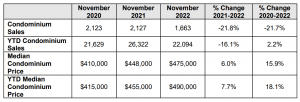

Condominiums

There were 1,663 condominium sales in November 2022, compared to 2,127 sales in November 2021 – a 21.8 percent decrease on a year-over-year basis. This marked the 15th consecutive month that condo sales have declined on a year-over-year basis. Meanwhile, the median sale price increased 6 percent on a year-over-year basis to $475,000 – a new all-time high for the month of November.

“The condo market followed very similar trends to the single-family market in November – a massive year-over-year decline in sales paired with a more modest increase in price,” Warren added. “It’s clear that neither market is immune from current economic conditions.”

Year-to-date, there have been 22,094 condo sales, a 21.8 percent decrease from the first 11 months of 2021 with a median sale price of $490,000, a 7.7 percent increase on the same basis.

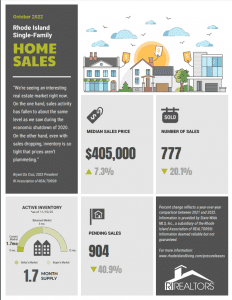

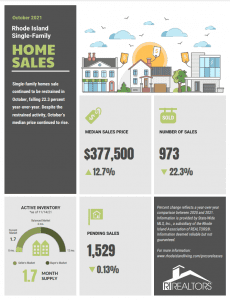

MA Single-Family Home Sales Decline Significantly in October as Median Price Experiences Modest Gain

Median condo price spikes 12.7 percent on a year-over-year basis.

PEABODY, November 16, 2022 – Single-family home sales across Massachusetts declined by double digits in October as a tightening inventory and rising interest rates continued to impact activity in the housing market, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Single-Family Homes

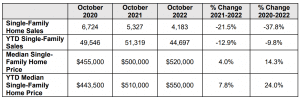

Last month, there were 4,183 single-family home sales in Massachusetts, a 21.5 percent decrease from October 2021 when there were 5,327 transactions. This marked the largest year-over-year decline in activity so far in 2022. Meanwhile, the median single-family sale price increased 4 percent on a year-over-year basis to $520,000, up from $500,000 in October 2021. Despite being a new all-time high for the month of October, this was the smallest percent increase on a year-over-year basis since June 2020.

“A dwindling inventory, rising interest rates, and the high cost of consumer goods continued to have an impact on homebuying activity across Massachusetts in October,” said Tim Warren, CEO of The Warren Group. “In fact, this is the fewest number of single-family home sales for the month of October since 2012. It’s also important to note that even though the median sale price continued to increase, the 4 percent gain was very modest when compared to the price hikes we’ve been seeing over the last few years.”

Year-to-date, there have been 44,697 single-family home sales in Massachusetts, a 12.9 percent decrease from the first 10 months of 2021. Meanwhile, the year-to-date median single-family home price increased 7.8 percent on the same basis to $550,000.

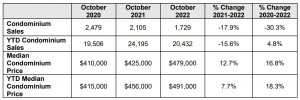

Condominiums

There were 1,729 condominium sales in October 2022, compared to 2,105 sales in October 2021 – a 17.9 percent decrease on a year-over-year basis. This marked the 14th consecutive month that condo sales have declined on a year-over-year basis. Meanwhile, the median sale price increased 12.7 percent on a year-over-year basis to $479,000 – a new all-time high for the month of October.

“The spike in the median condominium price is likely the result of prospective buyers turning to the condos as an alternative to single-family homes.” Warren added.

Year-to-date, there have been 20,432 condo sales, a 15.6 percent decrease from the first 10 months of 2021 with a median sale price of $491,000, a 7.7 percent increase on the same basis.

Massachusetts Single-Family Home, Condo Sales Down in November on

Year-Over-Year Basis

Median single-family home, condo prices reach new all-time highs for month of November.

PEABODY, December 21, 2021 – The median sale price for both single-family homes and condominiums continued to set records in November as sales declined on a year-over-year basis, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

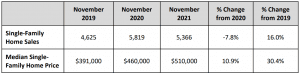

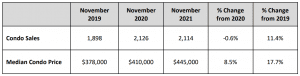

Single-family home and condo sales were significantly impacted in 2020 as a result of economic uncertainties surrounding COVID-19. In order to give a more accurate representation of activity in the Massachusetts real estate market, we are providing two years of data as a comparison in this month’s sales report.

Single-Family Homes

Last month, there were 5,366 single-family home sales in Massachusetts, a 7.8 percent decrease from November 2020 when there were 5,819 transactions. Compared to November 2019 (4,625 transactions), single-family home sales increased 16 percent. In November 2021, the median singlefamily sale price increased 10.9 percent on a year-over-year basis to $510,000, up from $450,000 in November 2020, and up 30.4 percent from November 2019, when the median sale price was $391,000. This marked a new all-time high for the median sale price for the month of November and the eighth consecutive month that the median single-family home price has been above $500,000.

“When looking at the November sales numbers, it’s important to do a two-year analysis to get a complete picture of the Massachusetts housing market,” said Tim Warren, CEO of The Warren Group. “One might think that a 7.8 percent decrease in sales is cause for alarm, but activity is still well above where it was during a ‘normal’ marketplace. In fact, November 2021 marked the second-most singlefamily home sales we’ve ever recorded in the month of November. In the coming year I think we will continue to see median prices increase, but at a more moderate pace. Sales volume is likely to be flat given the short supply, high prices, and rising interest rates.

Year-to-date, there have been 56,538 single-family home sales in Massachusetts, a 2.3 percent increase from the first 11 months of 2020. Meanwhile, the year-to-date median single-family home price increased 14.6 percent on the same basis to $510,000.

Condominiums

There were 2,114 condominium sales in November, a 0.6 percent decrease from November 2020 when there were 2,126 condo sales. Compared to November 2019 (1,898 transactions), condo sales were up 11.4 percent. Meanwhile, the median sale price increased 8.5 percent on a year-over-year basis to $445,000 – a new high for the month of November. Compared to November 2019 ($378,000), the median condo price was up 17.7 percent.

“The condo market followed similar trends to the single-family market in November – a decline in sales on a year-over-year basis, but activity was still well above what we normally see for the month,” Warren added. “The condo market stumbled especially hard in the second and third quarters last year due to COVID-19, so there’s plenty of pent-up demand from prospective buyers that’s still playing out over a year later.”

Year-to-date, there have been 26,316 condo sales, a 21.6 percent increase from the first 11 months of

2020 with a median sale price of $455,000, a 9.6 percent increase on the same basis.

PEABODY, November 26, 2019 – The median sale price for both single-family homes and condominiums continued to rise in October on a year-over-year basis, according to a new report from The Warren Group, publisher of Banker & Tradesman.

Last month, there were 5,224 single-family home sales recorded in Massachusetts, a 0.8 percent increase from October 2018 when there were 5,181 transactions. Meanwhile, the median single-family sale price rose 3.5 percent on a year-over-year basis to $388,000, which marked an all-time high for the month of October. Year-to-date, there have been 49,524 single-family home sales – a 1.4 percent decrease from the first ten months of 2018 – with a median sale price of $400,000 – a 3.9 percent increase on the same basis.

“And so, the record-setting continues,” said Tim Warren, CEO of The Warren Group. “The median single-family home price has reached new highs every month so far this year, and I fully expect this streak to continue for the remainder of 2019. The trend is a gradual increase in median price compared with the same month in the prior year. The increase in October was 3.5 percent, but over the first ten months of 2019, it was 3.9 percent. These are not huge gains, and in fact, the gains this year are lower than either of the two previous years.”

In October, there were 2,119 condominium sales, compared to 1,916 sales in October 2018 – a 10.6 percent increase. This marked the most condo sales seen in the month of October since 2006. Meanwhile, the median sale price spiked 11.1 percent on a year-over-year basis to $370,000 – an all-time high for the month of October. Year-to-date, there have been 20,526 condo sales – a 1.2 percent decrease – with a median sale price of $381,000 – a 4.4 percent increase from the first ten months of 2018.

“The condo market has been red hot so far this year, and October was no exception,” Warren continued. “Sales totaling 2,119 transactions marked the most condos sold in the month of October since 2006.”