Statistics

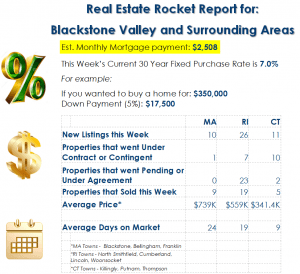

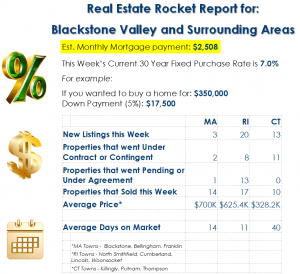

Market Update MA RI CT 07/15/24

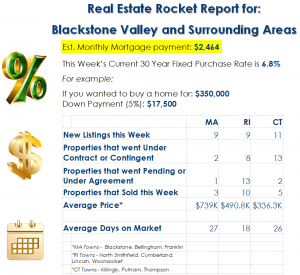

Market Update MA RI CT 07/01/24

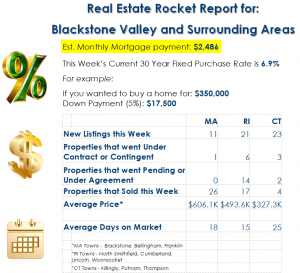

Market Update MA RI CT 06/24/24

Peace of Mind Prop. Mgmt. & Real Estate, Inc.

At Peace of Mind, we help you BUY the HOME you love, SELL the HOUSE you’re ready to leave, and BALANCE your INVESTMENT portfolio, “so you can sleep at night.”