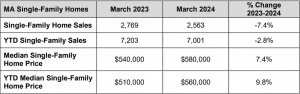

MA Single-Family Home, Condo Prices Continue Upward Climb in March on Year-Over-Year Basis

Single-family home sales down 7.4 percent from March 2023.

PEABODY, April 17, 2024 – Massachusetts single-family home and condo prices continued their upward climb in March, setting new records in the process, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

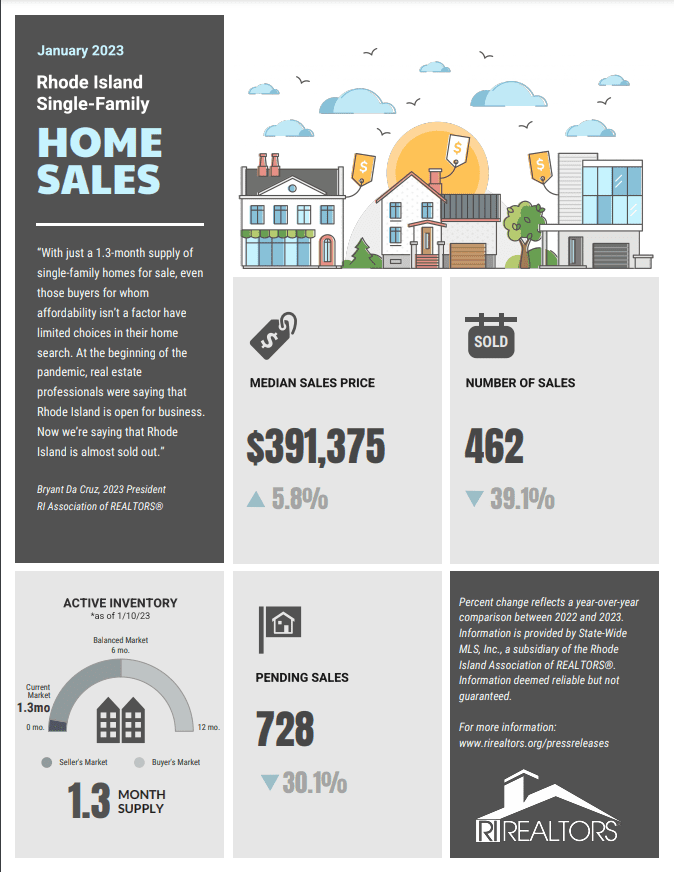

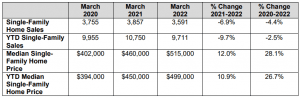

Single-Family Homes

Last month, there were 2,563 single-family home sales in Massachusetts, a 7.4 percent decline from March 2023. Meanwhile, the median single-family sale price increased 7.4 percent on a year-overyear basis to $580,000, up from $540,000 in March 2023 – a new all-time high for the month of March.

“Not surprisingly, Massachusetts median single-family home prices continued to set records in March,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “Despite the increase, we actually aren’t seeing the rapid, double-digit percent increases we were experiencing at the height of the pandemic and the subsequent months. Despite this slowdown, limited inventory will probably continue to be the biggest barrier to homeownership in the

coming months.”

Year-to-date, there have been 7,001 single-family home sales in Massachusetts, a 2.8 percent decrease from the first three months of 2023. Meanwhile, the year-to-date median single family home price increased 9.8 percent on the same basis to $560,000.

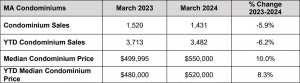

Condominiums

There were 1,431 condominium sales in March 2024, compared to 1,520 in March 2023 – a 5.9 percent decrease. Meanwhile, the median sale price rose 10 percent on a year-over-year basis to $550,000 – a new all-time high for the month of March.

“Last month, Massachusetts saw the fewest number of condo sales for the month of March since 2015,” Norton continued. “At the same time, the median condo price reached a new all-time high for the month of March. In fact, this is the first time the median condo price has surpassed $500,000 in the months of March ever, so a median price of $550,000 is pretty unprecedented.”

Year-to-date, there have been 3,482 condo sales, a 6.2 percent decrease from the first three months of 2023 with a median sale price of $520,000, an 8.3 percent increase on the same basis.

MA Single-Family Home Sales Flat in February as the Median Sale Price Spikes 10 Percent

Median condo price increases 6.5 percent on a year-over-year basis to $490,000

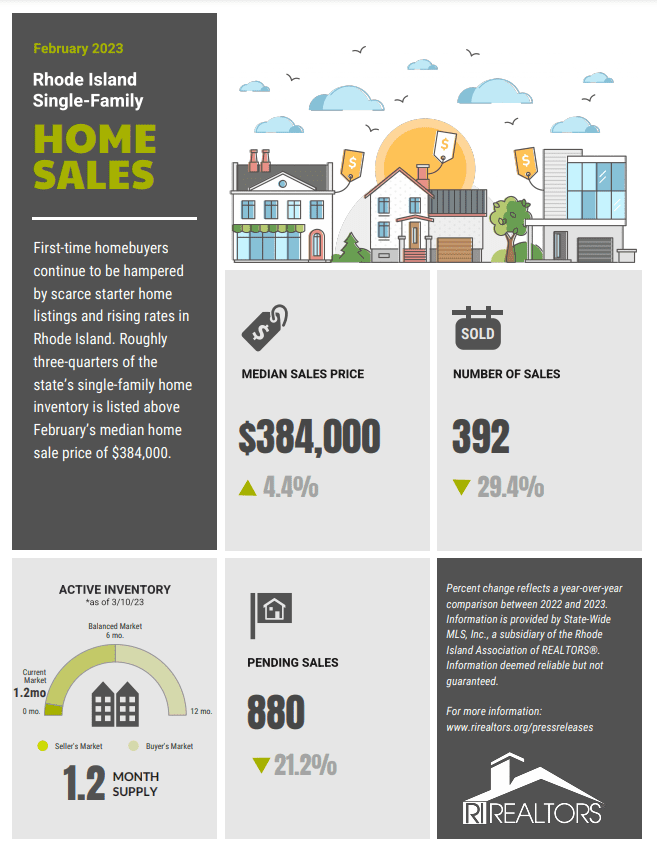

PEABODY, March 19, 2024 – Massachusetts single-family home sales were flat last month on a year-over-year basis as the median sale price reached a new all-time high for the month of February, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

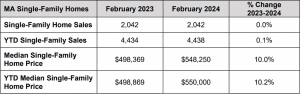

Single-Family Homes

Last month, there were 2,042 single-family home sales in Massachusetts, am 0.0 percent change from February 2023. Meanwhile, the median single-family sale price increased 10 percent on a yearover-year basis to $548,250, up from $498,369 in February 2023 – a new all-time high for the month of February.

“February was another record-setting month for median single-family home prices as sales activity was flat on a year-over-year basis,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “A lack of inventory is the biggest factor driving these trends, and with fewer and fewer homes hitting the market, we can fully expect to see more recording-setting pricespaired with a low sales volume in the coming months.”

Year-to-date, there have been 4,438 single-family home sales in Massachusetts, a 0.1 percent increase from the first two months of 2023. Meanwhile, the year-to-date median single family home price increased 10.2 percent on the same basis to $550,000.

Condominiums

There were 1,076 condominium sales in February 2024, compared to 1,017 in February 2023 – a 5.8 percent increase. Meanwhile, the median sale price rose 6.5 percent on a year-over-year basis to $490,000 – a new all-time high for the month of February.

“Although condo sales increased 5.8 percent in February on a year-over-year basis, activity is still nowhere near what we saw even two or three years ago,” Norton continued. “Record high prices and high interest rates with are likely a big factor in the long-term decline in activity, and prospective buyers shouldn’t expect much relief in the near future.”

Year-to-date, there have been 2,051 condo sales, a 6.5 percent decrease from the first two months

of 2023 with a median sale price of $499,900, a 6.4 percent increase on the same basis.

MA Median Single-Family Home Price Up More Than 10 Percent in January as Sales Level Off

January condo prices up 5.5 percent from 2023.

PEABODY, February 20, 2024 – Massachusetts single-family home and condominium prices continued to increase on a year-over-year, following trends recorded during the course of 2023, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

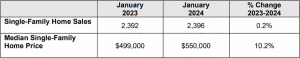

Single-Family Homes

Last month, there were 2,396 single-family home sales in Massachusetts, a 0.2 percent increase from January 2023 when there were 2,392 transactions. Meanwhile, the median single-family sale price increased 10.2 percent on a year-over-year basis to $550,000, a new all-time high for the month of January.

“Single-family sales were relatively flat from January 2023, but the slight uptick is the only yearover-year increase we’ve recorded since the middle of 2021,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “The issues that pained the Massachusetts housing market in 2023, like limited inventory, economic uncertainties, and higher interest rates are still at the forefront of prospective buyers. The Warren Group will keep a close eye on activity in the coming months, but in the coming months relief for prospective homebuyers with realistic budgets seems unlikely.”

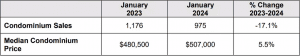

Condominiums

In January, there were 975 condominium sales, compared to 1,176 in January 2023 – a 17.1 percent decrease, and the fewest transactions recorded for the month of January since 2012. Meanwhile, the median sale price increased 5.5 percent on a year-over-year basis to $507,000 – a new all-time high for the month of January.

“Predictable condo trends continued into January,” Norton continued. “The median sale price recorded a new all-time high for the month of January as the numbers of sales declined by double digits. In fact, this is the fewest condo sales for the month of January since 2011. Condos are a hot commodity, but supply can’t keep up with demand.”

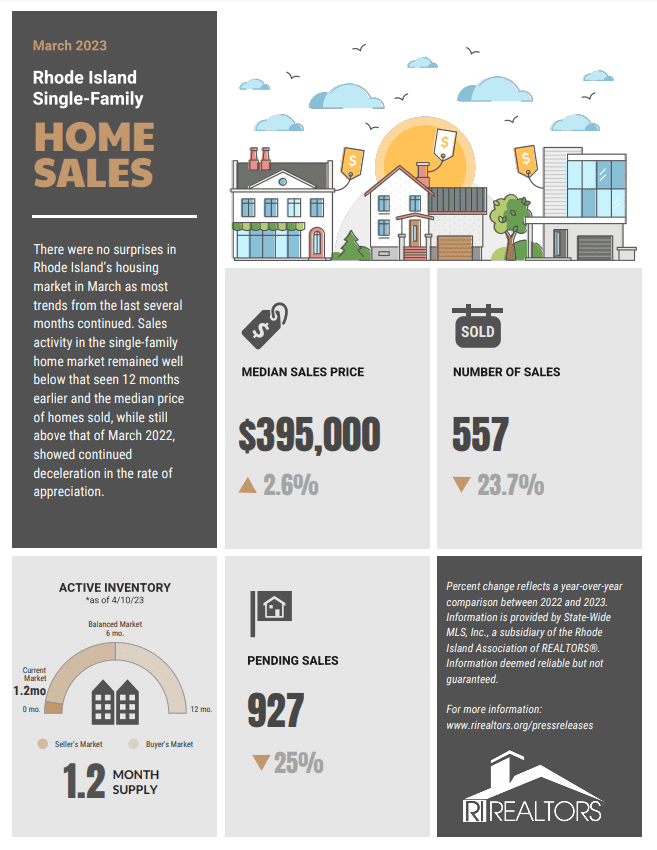

MA Single-Family Home, Condo Sales Continued to Plummet in March

Median single-family home price sets new record for the month of March at $540,000

PEABODY, April 19, 2023 – Massachusetts single-family home and condominium sales continued to decline in March as median sale prices showed no sign of slowing down, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Single-Family Homes

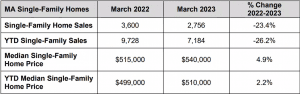

Last month, there were 2,756 single-family home sales in Massachusetts, a 23.4 percent decrease from March 2022 when there were 3,600 transactions. Meanwhile, the median single-family sale price increased 4.9 percent on a year-over-year basis to $540,000, up from $515,000 in March 2022 – a new all-time high for the month of March.

“The 2,756 single-family home sales we saw last month marked the fewest number of transactions we’ve seen in the month of March since 2011,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “A lack of inventory across Massachusetts continues to be the biggest factor in the declining sales volume. But when paired with rising interest rates and uncertainties about the economy, we can expect to see similar trends as the spring housing market

starts to heat up.”

Year-to-date, there have been 7,184 single-family home sales in Massachusetts, a 26.2 percent decrease from the first three months of 2022. Meanwhile, the year-to-date median single family home price increased 2.2 percent on the same basis to $510,000.

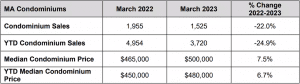

Condominiums

There were 1,525 condominium sales in March 2023, compared to 1,955 in March 2022 – a 22 percent decrease. Meanwhile, the median sale price rose 7.5 percent on a year-over-year basis to $500,000.

“Once again, the condo market followed almost identical trends as the single-family market,” Norton continued. “However, with rising interest rates and single-family home prices setting new records, condos might be a slightly more affordable option for homeownership for prospective buyers across

Massachusetts.”

Year-to-date, there have been 3,720 condo sales, a 24.9 percent decrease from the first three

months of 2022 with a median sale price of $480,000, a 6.7 percent increase on the same basis.

MA Single-Family Home, Condo Sales Decline More Than 20 Percent in February

Greater Boston single-family, condo sales down 18.9 percent and 23.7 percent, respectively.

PEABODY, March 22, 2023 – Massachusetts single-family home and condominium sales continued to decline in February as the median sale prices trended higher at a more moderate pace, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

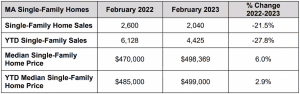

Single-Family Homes

Last month, there were 2,040 single-family home sales in Massachusetts, a 21.5 percent decrease from February 2022 when there were 2,600 transactions. Meanwhile, the median single-family sale price increased 6 percent on a year-over-year basis to $498,369, up from $470,000 in February 2022 – a new all-time high for the month of February.

“Despite another record-setting month for the median single-family home price, the 6 percent gain we saw was a much more moderate gain compared to what we’ve seen over the last couple of years,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “A lack of inventory, higher interest rates, and economic uncertainties continue to be the biggest barriers to entry for prospective homebuyers. Speaking of the economy, the most recent bank failures may shake consumer confidence in the coming months, which could yield even further declines in transactions not associated with a lack of inventory.”

Year-to-date, there have been 4,425 single-family home sales in Massachusetts, a 27.8 percent decrease from the first two months of 2022. Meanwhile, the year-to-date median single family home price increased 2.9 percent on the same basis to $499,000.

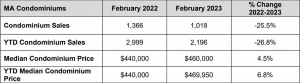

Condominiums

There were 1,018 condominium sales in February 2023, compared to 1,366 in February 2022 – a 25.5 percent decrease. Meanwhile, the median sale price rose 4.5 percent on a year-over-year basis to $460,000.

“Condo trends were in lockstep with single-family homes in February,” Norton continued. “Inventory is down, there aren’t enough new listings to keep up with demand, and the median condo price continues to climb – just at a more modest pace.”

Year-to-date, there have been 2,196 condo sales, a 26.8 percent decrease from the first two months of 2022 with a median sale price of $469,950, a 6.8 percent increase on the same basis.

MA Median Single-Family Home, Condo Prices Reach New All Time High for Month of January

Single-family home sales are down 32.6 percent on a year-over-year basis.

PEABODY, February 22, 2023 – Massachusetts single-family home and condominium prices continued to set records in January as sales activity plummeted by double digits, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

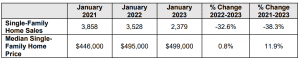

Single-Family Homes

Last month, there were 2,379 single-family home sales in Massachusetts, a 32.6 percent decrease from January 2022 when there were 3,528 transactions. This marked the fewest number of single-family home sales for the month of January since 2011. Meanwhile, the median single-family sale price increased 0.8 percent on a year-over-year basis to $499,000, a new all-time high for the month of January.

“The lack of inventory in the housing market continued to add upward pressure to the median single-family home price,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “The 2,379 single-family home sales marked the fewest number of transactions for the month of January since 2011 and the lack of inventory is mostly to blame. Add in the fact that interest rates are nearly double what they were a year ago and the rising cost of consumer goods, and we can expect sales numbers to continue their downward trend in the coming months.”

Condominiums

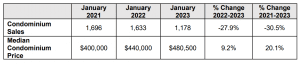

In January, there were 1,178 condominium sales, compared to 1,633 in January 2022 – a 27.9 percent decrease and the fewest transactions recorded for the month of January since 2015. Meanwhile, the median sale price spiked 9.2 percent on a year-over-year basis to $480,500 – a new all-time high for the month of January.

“Condo sales activity followed similar trends to single-family homes in January, but the biggest different was the 9.2 percent increase in the median condo price,” Norton continued. “The median condo price of $480,500 marked a new all-time high for the month of January. Historically, condos were a more affordable alternative to single-family homes, but that doesn’t appear to be the case any longer.”

MA Single-Family Home, Condo Sales Continue Their Slide in March on Year-Over-Year Basis

Median prices reach new highs for the month of March.

PEABODY, April 20, 2022 – Massachusetts single-family home and condominium sales declined in March on a year-over-year basis as median prices reached new highs in the process, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Single-Family Homes

Last month, there were 3,591 single-family home sales in Massachusetts, a 6.9 percent decrease from March 2021 when there were 3,857 transactions. Meanwhile, the median singlefamily sale price increased 12 percent on a year-over-year basis to $515,000, up from $460,000 in March 2021 – a new all-time high for the month of March.

“Low inventory continues to plague the real estate market in Massachusetts,” said Tim Warren, CEO of The Warren Group. “The number of homes for sale has been declining for a decade or

more and that trend has led to a lower sales volume and is pushing prices higher. Couple this with rising mortgage rates – which recently hit 5 percent for the first time since 2011 – and housing affordability is rapidly waning. First-time homebuyers are flocking to rural communities and blue-collar cities to take advantage of attractive purchase prices.”

Year-to-date, there have been 9,711 single-family home sales in Massachusetts, a 9.7 percent decrease from the first three months of 2021. Meanwhile, the year-to-date median single family home price increased 10.9 percent on the same basis to $499,000.

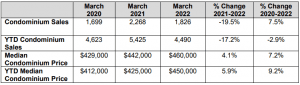

Condominiums

There were 1,826 condominium sales in March 2022, compared to 2,268 in March 2021 – a 19.5 percent decrease. Meanwhile, the median sale price increased 4.1 percent on a year-overyear basis to $460,000 – a new all-time high for the month of March.

“Condo sales took a big hit in March on a year-over-year basis, but activity was actually up 7.5 percent when comparing activity to what we saw in March 2020,” Warren continued. “The condo

inventory isn’t quite as depleted as the single-family market, so more buyers could turn to condos in the coming months as an alternative to single-family homes.”

Year-to-date, there have been 4,490 condo sales, a 17.2 percent decrease from the first three months of 2021 with a median sale price of $450,000, a 5.9 percent increase on the same basis.

MA Single-Family Home, Condo Sales Decline in February as Prices Continue to Push Higher

Median price for single-family gained 5.4 percent on year-over-year basis to $470,000.

PEABODY, March 22, 2022 – Massachusetts single-family home and condominium sales declined by double digits in February as supply continued to fail to keep up with demand, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

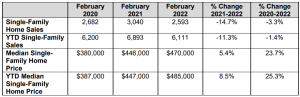

Single-Family Homes

Last month, there were 2,593 single-family home sales in Massachusetts, a 14.7 percent decrease from February 2021 when there were 3,040 transactions. Meanwhile, the median single-family sale price increased 5.4 percent on a year-over-year basis to $470,000, up from $446,000 in February 2021 – a new all-time high for the month of February.

“The median sale price for single-family homes continued its upward climb in February as inventory struggled to keep up with demand,” said Tim Warren, CEO of The Warren Group. “The Massachusetts Association of Realtors reported that inventory of single-family homes for sale was down 50 percent in January. New listings and pending sales were down as well. February was the eighth month in a row where the number of homes sold declined while the median price continued to rise. It is a familiar trend, one that is likely to continue unless sellers flood the spring market with new homes.”

Year-to-date, there have been 6,111 single-family home sales in Massachusetts, an 11.3 percent decrease from the first two months of 2021. Meanwhile, the year-to-date median single family home price increased 8.5 percent on the same basis to $485,000.

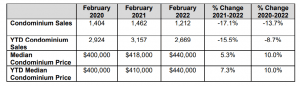

Condominiums

There were 1,212 condominium sales in February 2022, compared to 1,462 in February 2021 – a 17.1 percent decrease. Meanwhile, the median sale price rose 5.3 percent on a year-overyear basis to $440,000 – a new all-time high for the month of February.

“The 1,212 condo sales we saw in February marked the fewest condo sales for the month since 2018,” Warren added. “We see the same pattern with the condo market as we see with singlefamily home sales. Inventory, new listings, and pending sales declined, yet the median sale price continued to rise.”

Year-to-date, there have been 2,669 condo sales, a 15.5 percent decrease from the first two months of 2021 with a median sale price of $440,000, a 7.3 percent increase on the same basis.

MA Single-Family Home, Condo Sales Fall in January as Median Prices Continue to Climb

Strong demand for housing struggles with low inventory.

PEABODY, February 16, 2022 – Massachusetts single-family home and condominium sales fellin January on a year-over-year basis as median sale prices reached new highs for the month, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

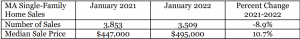

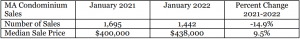

Single-Family Homes

Last month, there were 3,509 single-family home sales recorded in Massachusetts, an 8.9 percent decrease from January 2021 when there were 3,853 transactions. Meanwhile, the median single-family sale price spiked 10.7 percent on a year-over-year basis to $495,000, up from $447,000 in January 2021. This marked a new all-time high for the month of January but was also the first time the statewide median sale price has dipped below $500,000 since March 2021

“While it’s true the number of single-family home sales dropped in January on a year-over-year basis, it’s important to look at the whole picture,” said Tim Warren, CEO of The Warren Group. “In January 2021, there were 3,853 single-family transactions, which was the most transactions we’ve seen since January 1999. This makes the 8.9 percent decrease between January 2021 and January 2022 rather modest. In fact, the number of sales has fallen anywhere from 6 to 21 percent in each of the past 6 months. Demand for homes remains strong, but the inventory of homes for sale at year-end was 50 percent of what it was a year ago. Consequently, prices

continue to rise by double digits.”

Condominiums

In January, there were 1,442 condominium sales, compared to 1,695 in January 2021 – a 14.9 percent decrease and the fewest transactions recorded for the month of January since 2019. Meanwhile, the median sale price increased 9.5 percent on a year-over-year basis to $438,000 – a new all-time high for the month of January.

“Condo activity followed nearly similar trends to single-family homes in January,” Warren added. “Sales were down from the totals in January 2021 and 2020, but the median price set a new record for the month.”

MA Single-Family Home Sales and Median Price Remained Hot in February

Median price for single-family gained 17.1% to $445,000.

PEABODY, March 18, 2021 – Massachusetts single-family homes and condominiums continued to set records in February as buyer demand showed no sign of slowing down, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Last month, there were 3,026 single-family home sales recorded in Massachusetts, a 12.8 percent increase from February 2020 when there were just 2,682 transactions. This marked the most singlefamily home sales in the month of February since 2004. Meanwhile, the median single-family sale price surged 17.1 percent on a year-over-year basis to $445,000, up from $380,000 in February 2020 – a new all-time high for the month of February. The median single-family home price has now been above $400,000 for 12 straight months.

“The high level of demand paired with a shrinking inventory has added significant upward pressure on the median single-family home price, which has now been above $400,000 for over a year,” said Tim Warren, CEO of The Warren Group. “Whether you’re a first-time homebuyer, a retiree looking to downsize, or looking to your “forever” home, good luck, because the competition is fierce, and prices reflect that.”

Year-to-date, there have been 6,866 single-family home sales in Massachusetts, a 10.7 percent increase from the first two months of 2020. Meanwhile, the year-to-date median single family home price increased 15.3 percent on the same basis to $445,750. There were 1,459 condominium sales In February 2021, compared to 1,404 in February 2020 – a 3.9 percent increase and the most transactions recorded for the month of February since 2007. Meanwhile, the median sale price rose 4.8 percent on a year-over-year basis to $419,000 – a new all-time high for the month of February and the eighth consecutive month that the median condo price has been more than $400,000.

“The condo market saw moderate gains in February compared to single-family homes, but we could be in for a surprise in the coming months,” Warren added. “With stage four of Gov. Charlie Baker’s reopening plan scheduled for March 22, the Red Sox, Celtics, and Bruins starting to allow fans back into games, and almost a million people vaccinated against COVID-19, a return to normalcy in major metro areas is on the horizon, which will make condos much more appealing to buyers again.”

Year-to-date, there have been 3,161 condo sales, an 8.1 percent increase from the first two months of

2020 with a median sale price of $410,000, a 2.5 percent increase on the same basis.

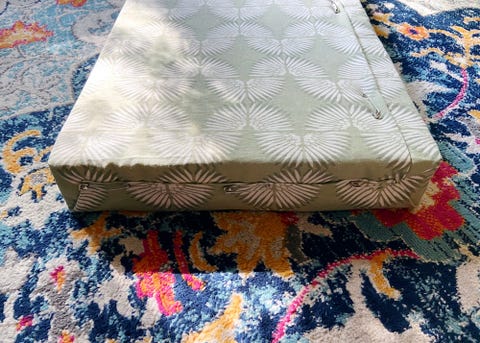

I Made This No-Sew Window Seat Cushion for Just $50, and It Only Took Me 20 Minutes

It’s my new favorite spot!

The first thing I needed to determine was how it would be filled, and foam seemed like the best bet. I did some research and found a roll of multi-purpose foam at Home Depot for $25 that was wider and longer than my window, so I knew it would be easy to cut it down to fit. Next was the cushion cover. I have pretty solid sewing skills, but without a sewing machine, a cushion cover seemed like more work than I wanted to put in. A search for no-sew window seat cushion tutorials led me to DIYs that used plywood and a staple gun, but I didn’t want to have to worry about getting wood cut to fit the window or buying a staple gun, since we didn’t own one. The more I thought about it, the more I realized that the only parts of the cushion that would be visible were the top and the front—the whole point was for the cushion to take up the whole width of the window, so the sides would be hidden anyway. I decided to just fold the fabric strategically around it and pin it tight, essentially like wrapping up a present. I wasn’t sure it would work, but in the end, I was so happy with how it came out. Here’s how I did it:

You’ll need:

- Foam that’s at least 3″ thick (anything thinner might not be too comfortable!)

- Fabric of your choice

- Large safety pins

- Tape measure

You’ll also need your preferred method of cutting through the foam. I used scissors because I admittedly didn’t think this part through ahead of time, but that was a challenge, to say the least. A small hand-saw or electric knife would probably work a lot better!

Step 1: Measure your window sill

Measure the width of the inside of your window from edge to edge. You’ll want a pretty exact measurement so that the cushion fits snugly inside and doesn’t move around. Then measure the depth. I subtracted an inch from the depth measurement so that my cushion wouldn’t hang over the sill and the edge of the window sill would still show just a bit, because I thought it looked neater. My sill is 58″ wide by 18″ deep, so I used 58″ by 17″ as my measurements.

Step 2: Purchase foam and and fabric to fit

For the foam, find a roll that is wider and longer than your window seat so you can cut it down to size. The foam I used was 24″ by 72″ and would likely work for most windows. Then, use your measurements to determine how much fabric you need—if you’re using 3″ thick foam like I did, you’ll want the fabric to be at least 6 inches longer than the long side of your foam, and more than double the width of the foam. Because the measurements I was working with were 58″ by 17″, I ordered two yards of my chosen fabric.

Step 3: Cut the foam to fit

Mark out your measurements on your foam—I found it helpful to draw out the full lines of where I was going to cut, since it can be difficult to cut foam in a straight line without a guide. Then, cut using your tool of choice.

Step 4: Wrap foam in fabric and pin in place

Now, for the easy part: You’re going to wrap the fabric around your foam just like you’re wrapping a gift. Place the fabric on a clean surface with the outside facing down, then lay the foam in the center of it. Start by wrapping the bottom side up, and pin it into the foam in a straight line.

Once you’ve got the bottom half pinned, pull the top taut (it’s helpful if you have someone to hold the foam while you do this for a tighter fit) and around the foam until it overlaps the fabric you just wrapped over the bottom. If the fabric is too long, you can fold it under or trim it. Pin in a straight line.

Next, you’ll need to wrap up the sides of the cushion. Start by folding in the shorter sides, then fold the top down (or bottom up—whatever is easier for you!) and pin into the foam, pulling taut. Fold up the other half and pin in place, again, pulling taut as you go.

Repeat on the other side, and voila! You officially have a finished no-sew window seat cushion.

Step 5: Place on window and style

Place the cushion on your window sill, pinned side down. It should fit perfectly, and all that’s left for you to do is to style as you please. We added some throw pillows to make it feel cozier and to have back support on hand for when we do want to sit in the window. Drinking tea and looking out at the park is just as lovely as I imagined, and as you can see, the cat is pretty pleased. Not bad for a project that cost $50 and took about 20 minutes to complete!

Cali napping in her new favorite spot after a long morning of bird-watching.

Note: You may find that the fabric is a little loose when you’re done pinning it or with use over time, especially if you have a cat who’s an avid bird-watcher—if that happens, just undo your sides and top layer pins, pull tighter, and re-pin for a better fit. I’ve found it’s also super easy to just smooth out the fabric by hand when it’s on the sill for a quick fix.

MA Single-Family Home, Condo Prices Surge in January to New Highs

Median condo price surpasses single-family price.

PEABODY, February 26, 2020 – Massachusetts single-family home and condominium prices surged in January on a year-over-year basis, as the local housing market continued its upward climb at the start of the new year, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Last month, there were 3,507 single-family home sales recorded in Massachusetts, an 8.1 percent increase from January 2019 when there were 3,244 transactions. Meanwhile, the median single-family sale price increased 6.8 percent on a year-over-year basis to $393,000, up from $355,000 in January 2019 and a new all-time high for the month of January.

“The considerable momentum in the single-family housing market in 2019 clearly has carried over into the new year,” said Tim Warren, CEO of The Warren Group. “The median sale price of $393,000 marked an all-time high for the month of January, and if this is any indicator, we can expect 2020 to be another record-setting year for Massachusetts real estate.”

In January, there were 1,517 condominiums sold, compared to 1,248 in January 2019 – a 21.6 percent increase and the most transactions recorded for the month of January since 2007. The median sale price followed a similar trend, rising 12.4 percent on a year-over-year basis to $399,000.

“The median condo price surpassing the median single-family home price is truly a rarity,” Warren continued. “The last time this occurred was in March 2018, and has now occurred just five times in history. Newly built and renovated condos are driving the market – especially in the Greater Boston area – and commanding higher prices.”

Spring housing market could be ‘coolest in recent years,’ Realtor.com says

PUBLISHED WED, FEB 27 2019 • 12:10 PM EST | UPDATED WED, FEB 27 2019 • 6:25 PM EST

Diana Olick

KEY POINTS

- The median price of a home listed in February jumped 7 percent annually to $294,800, according to Realtor.com.

- The increase came as the number of listings rose 6 percent, with an additional 73,000 listings compared with a year ago.

The supply of homes for sale is finally rising, but fewer buyers are able to afford these homes. That could result in a much slower spring market.

Spring is usually the high season for housing, but high home prices have been taking their toll for months. The numbers point to potential trouble ahead.

The median price of a home listed in February jumped 7 percent annually to $294,800, according to Realtor.com. The price increase came as the number of listings rose 6 percent, with an additional 73,000 listings compared with a year ago.

“This is the fifth consecutive month that we’ve seen housing inventory increase, especially in large markets,” said Danielle Hale, Realtor.com’s chief economist.

Buyers did come back in January, with signed contracts jumping a wider-than-expected 4.6 percent month to month, according to the National Association of Realtors. Most point squarely to the drop in mortgage rates that occurred in December as the cause for the rebound. Gains were strongest in the South, where prices are relatively low, and weakest in the West, where they are highest.

Volume nationally, however, was still lower than in January of last year.

“That’s a sign that while housing is going to pick up from late 2018′s sluggish level, which we expected given lower mortgage rates, it’s still at a slower pace than we what saw in early 2018. Affordability continues to be a challenge for first-time buyers,” added Hale.

The biggest supply increases were in the nation’s 50 largest metropolitan markets, where inventory overall was 11 percent higher. The West Coast led the way, with San Jose seeing a 125 percent increase in the number of listings. That is likely because more of these pricey listings are going unsold and piling up.

Seattle, also an overheated housing market, saw an 85 percent jump in listings, followed by a 53 percent increase in San Francisco, 39 percent increase in San Diego, and 36 percent increase in Portland, Oregon.

Slashing prices

Sellers are starting to respond by cutting prices. In February, 39 of the 50 largest markets saw an increase in share of price cuts, according to the report. Las Vegas saw the biggest change, a 19 percent jump in the number of sellers slashing their asking prices. That is absolutely due to higher supply.

By the end of January, there were 7,254 single-family homes listed for sale without any sort of offer in Las Vegas. That’s up 95 percent from one year ago, according to the Greater Las Vegas Association of Realtors.

Supply nationally, however, differs dramatically by price point. In February, the number of homes priced at or above $750,000, which is close to three times the national median, increased by 11 percent annually, according to Realtor.com.

The opposite is happening at the entry level. The supply of homes priced at $200,000 or below has decreased 7 percent year-over-year, indicating that availability of affordable homes will remain an issue for many potential buyers, especially first-time buyers. The share of first-time buyers fell in January, according to the National Association of Realtors.

“I think the spring housing market will see some signs of a rebound, but it will be slower than expectations, slower than what homebuyer demand would suggest and that’s because housing has these structural headwinds that are not going away, even when interest rates are going slower and even as wages are going up. The structural issues are on the supply side,” said Nela Richardson, a senior investment strategist at Edward Jones.

The nation’s homebuilders are not helping much at the entry level, as they continue to focus on the move-up market. Housing starts and builder permits have shown no major growth and continue to sit at historically low levels, especially given today’s high demand from millennials.

“Looking forward, we continue to point to a more mixed set of fundamentals that will likely result in the housing market recovery continuing at the more tepid pace than seen over the last 1 to 2 years, led by job growth remaining positive although decelerating, credit continuing to ease at a modest pace, affordability declining and new home inventory rising,” wrote Michael Rehaut, a housing analyst with J.P. Morgan.

MA Single-Family Home Sales, Median Price Climb in February

Condo sales up as median sale price edges lower.

PEABODY, March 27, 2019 – Massachusetts single-family home sales spiked on a year-over-year basis as the median sale price reached an all-time high for the month of February, according to a new report from The Warren Group, publisher of Banker & Tradesman.

Last month, there were 2,810 total sales recorded in Massachusetts, an 8.7 percent increase from February 2018 when there were 2,585 transactions. This marked the highest number of sales for the month of February since 2016. Meanwhile, the median single-family sale price increased 7.4 percent on a year-over-year basis to $365,000, which marked an all-time high for the month of February. Year-to-date, there have been 6,044 single family home sales with a median sale price of $365,000.

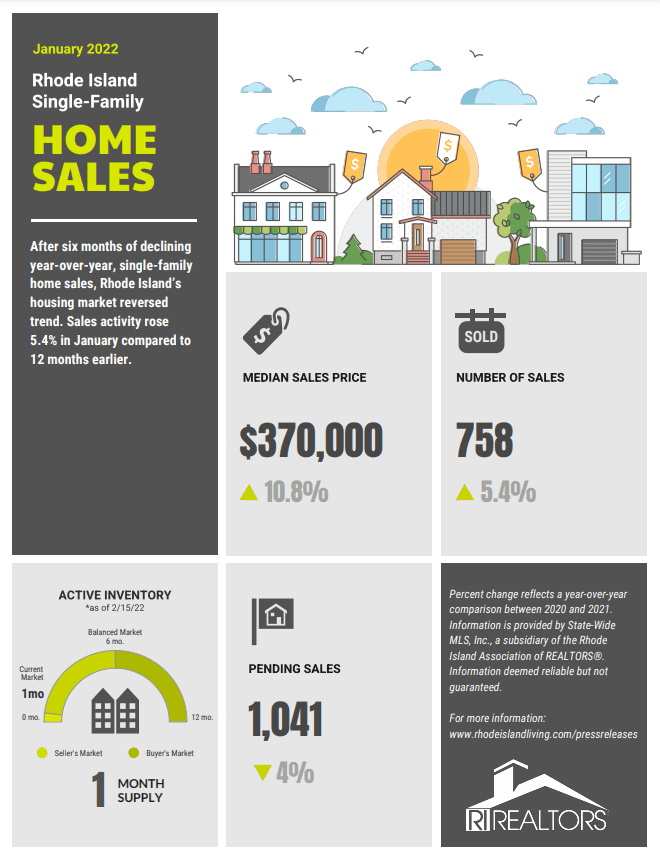

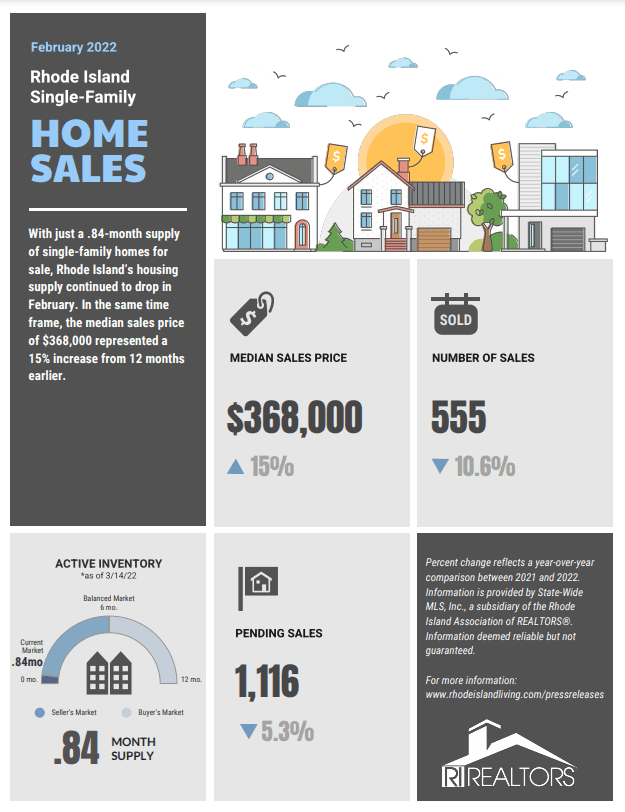

First Down Program

Financial Assistance for Homebuyers in Rhode Island

In an effort to assist potential homebuyers afford the costs of buying a new home, Rhode Island Housing (RIH) established the First Down Program, a forgivable loan secured by a second mortgage that targets the six Rhode Island communities most affected by the foreclosure crisis: Providence, Pawtucket, Woonsocket, Warwick, Cranston and East Providence. The program aids first-time homebuyers with $7,500 in down payment assistance.

Eligibility Requirements

The First Down Program is available to eligible, first-time homebuyers who:

- Are purchasing a one- to four- family home or condominium.

- Meet Rhode Island Housing loan and income limits.

- Are financing their first mortgage through a participating lender or Rhode Island Housing.

- Plan to occupy the home as their primary residence.

Loan Limits

The down payment assistance of $7,500 is forgivable after five years of owning the home, as long as borrowers use it as their primary residence (i.e. buyers do not need to repay the amount if they reside in the home for five years). The maximum loan limit allowed is $424,100 for a one- to four-family home or eligible condominium.

Income Limits

n eligible first-time homebuyers’ annual household income must fall under the minimum of $87,360 for a 1-2 person household, or $101,920 for a 3+ person household.

The First Down Program is only available to borrowers financing their home with a Rhode Island Housing first mortgage, available through their network of participating lenders and the Rhode Island Housing Loan Center. RIH requires that a portion of First Down loan be repaid if buyers sell, refinance, or transfer their home within five years of closing the loan.

*The Rhode Island Housing determined the targeted areas that would be eligible for the First Down program by evaluating all communities in the state at a zip code level. RIH identified which areas had higher than average indicators of seriously delinquent mortgage loans, negative equity, distressed sales, short sales, foreclosure rates and vacant homes.