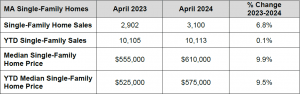

MA April Single-Family Home Sales See Largest Year-Over-Year Increase Since 2021

Median single-family home price reaches $610,000 in April.

PEABODY, May 21, 2024 – Massachusetts single-family home sales increased 6.8 percent in April on a year-over-year basis, marking the largest year-over-year increase since June 2021, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Single-Family Homes

Last month, there were 3,100 single-family home sales in Massachusetts, a 6.8 percent increase from April 2023. Meanwhile, the median single-family sale price increased 9.9 percent on a yearover- year basis to $610,000, up from $555,000 in April 2023 – a new all-time high for the month of April and the first time the median single-family home prices has exceeded the $600,000 mark in 2024.

“The number of single-family homes sold in Massachusetts increasing by such a large percent over the year prior is a positive sign for both buyers and sellers,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “The market has been exceedingly tight in recent years as mortgage rates and building costs rose. More sales didn’t move the needle on home prices, however; the median single-family home sale price in April rose nearly 10 percent. This also marked the first time the median price has exceeded $600,000 in 2024, approaching the record high of $615,000 set in June 2023.”

Year-to-date, there have been 10,113 single-family home sales in Massachusetts, a 0.1 percent increase from the first four months of 2023. Meanwhile, the year-to-date median single family home price increased 9.5 percent on the same basis to $575,000.

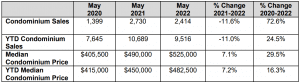

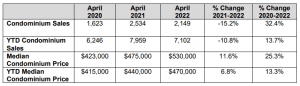

Condominiums

There were 1,613 condominium sales in April 2024, compared to 1,495 in April 2023 – a 7.9 percent increase. Meanwhile, the median sale price rose 3.4 percent on a year-over-year basis to $532,500 – a new all-time high for the month of April.

“Though the median sale price of a Massachusetts condo rose a mere 3.4 percent, that was enough to read an all-time high for the month of April of $532,500,” Norton added. “The condo market faces the same headwinds as the single-family market, and a rise in the number of sales is a welcome change.”

Year-to-date, there have been 5,094 condo sales, a 2.2 percent decrease from the first four months of 2023 with a median sale price of $525,000, a 7.1 percent increase on the same basis.

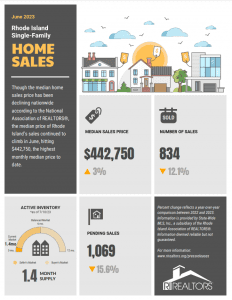

MA Median Single-Family Home, Condo Prices Reach New AllTime Highs in June, New Data Reveals

Single-family home sales down 20.5 percent on a year-over-year basis.

PEABODY, July 25, 2023 – Sales activity for both single-family homes and condominiums declined in June on a year-over-year basis, as median sale prices reached new all-time highs, according to a new report from The Warren Group, a leading provider of national real estate and transaction data.

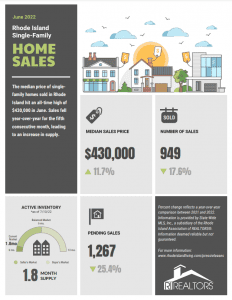

Single-Family Homes

Last month, there were 5,004 single-family home sales in Massachusetts, a 20.5 percent decrease from June 2022 when there were 6,297 transactions. Meanwhile, the median single-family sale price increased 1 percent on a year-over-year basis to $612,250, a new record for single-family homes.

“Despite interest rates nearly double what they were this time last year, the Massachusetts singlefamily housing market broke another record in June,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “Last month, the median sale price of $612,250 marked a new all-time high for single-family homes. Just three years ago, single-family home sale monthly median prices were consistently below $500,000 and interest rates were hovering around

three percent. Single-family homes in Massachusetts have never been less affordable.”

Year-to-date, there have been 18,706 single-family home sales in Massachusetts, a 24.3 percent decrease from the first six months of 2022. Meanwhile, the year-to-date median single family home price increased 0.9 percent on the same basis to $555,000.

Condominiums

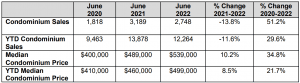

There were 2,372 condominium sales in June 2023, compared to 2,765 in June 2022 – a 14.2 percent decrease. Meanwhile, the median sale price increased 1.9 percent on a year-over-year basis to $545,000, up from $535,000 in June 2022, marking a new all-time high for the statewide median condo price.

“Condos followed similar trends to single-family homes last month,” Norton added. “The median sale price of $545,000 also marked a new all-time high. Historically, condos have been a more affordable alternative to single-family homes, but that’s no longer necessarily the case.”

Year-to-date, there have been 9,432 condo sales, a 23.2 percent decrease from the first six months of 2022 with a median sale price of $510,000, a 2.2 percent increase on the same basis.

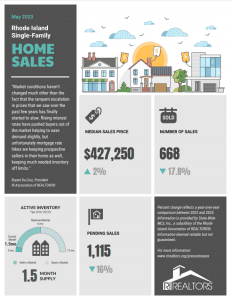

MA Median Single-Family Home, Condo Prices Remain Relatively Flat in May, New Data Reveals

Single-family home sales fell more than 25 percent on a year-over-year basis.

PEABODY, June 20, 2023 – Sales activity for both single-family homes and condominiums continued to decline in May, as the median sale prices remained relatively flat, according to a new report from The Warren Group, a leading provider of national real estate and transaction data.

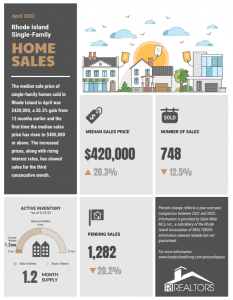

Single-Family Homes

Last month, there were 3,611 single-family home sales in Massachusetts, a 25.1 percent decrease from May 2022 when there were 4,818 transactions. Meanwhile, the median single-family sale price fell by just 0.2 percent on a year-over-year basis to $589,000, down from $590,000 in May 2022. This marked the second consecutive month that the median single-family home price declined on a year-over-year basis.

“With 3,611 sales recorded and a noticeable 25.1 percent dip in year-over-year figures, the singlefamily market continues to exhibit trends we’ve seen in recent months,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “The big differentiator in May is that the median single-family home price declined for the second straight month on a yearover-year basis. With elevated interest rates, it’s even more expensive for buyers to purchase homes, and price trends are reflecting that.”

Year-to-date, there have been 13,701 single-family home sales in Massachusetts, a 25.6 percent decrease from the first five months of 2022. Meanwhile, the year-to-date median single family home price increased 1.9 percent on the same basis to $540,000.

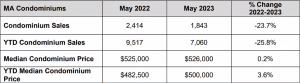

Condominiums

There were 1,843 condominium sales in May 2023, compared to 2,414 in May 2022 – a 23.7 percent decrease. Meanwhile, the median sale price increased just 0.2 percent on a year-over-year basis to $526,000, up from $525,000 in May 2022. “The Massachusetts condo market has not been immune to the imbalance in supply and demand.”

Norton added. “Amidst this dynamic environment, one might think that opportunity is knocking for sellers. However, with such limited supply, it’s a question of where sellers will go after they list their condos.”

Year-to-date, there have been 7,060 condo sales, a 25.8 percent decrease from the first five months of 2022 with a median sale price of $500,000, a 3.6 percent increase on the same basis.

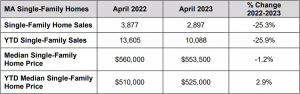

MA Single-Family Home, Condo Prices Decline in April, New Data Reveals

Median single-family home price sees first year-over-year decline since 2018.

PEABODY, May 16, 2023 – The median sale price for both single-family homes and condominiums declined in April as the lack of inventory and elevated interest rates continued to weigh on market activity, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

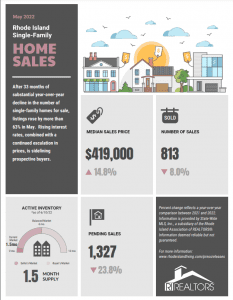

Single-Family Homes

Last month, there were 2,897 single-family home sales in Massachusetts, a 25.3 percent decrease from April 2022 when there were 3,877 transactions. Meanwhile, the median single-family sale price declined on a year-over-year basis for the first time since 2018, falling 1.2 percent to $553,500, down from $560,000 in April 2022.

“In the ever-evolving landscape of the Massachusetts housing market, April saw a notable decline in sale prices, the first time the median sale price decreased in five years,” said Cassidy Norton, Associate Publisher and Media Relations Director of The Warren Group. “Limited housing inventory was a persistent hurdle, constraining buyer options and intensifying competition. The scarcity of available properties may have prompted hesitant homeowners to delay listing their homes, further exacerbating the supply-demand imbalance. Economic factors also contributed to the declining market performance. Historically higher mortgage interest and inflation rates added an element of caution among prospective buyers. The upward pressure on borrowing costs dampened affordability

and consequently tempered demand.”

Year-to-date, there have been 10,088 single-family home sales in Massachusetts, a 25.9 percent decrease from the first four months of 2022. Meanwhile, the year-to-date median single-family home price increased 2.9 percent on the same basis to $525,000.

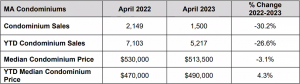

Condominiums

There were 1,500 condominium sales in April 2023, compared to 2,149 in April 2022 – a 30.2 percent decrease. Meanwhile, the median sale price fell 3.1 percent on a year-over-year basis to $513,500.

“As has been the case all year, the Massachusetts condo market saw a significant decline in sales in April,” Norton added. “The market’s response was further underscored by a 3.1 percent decrease in prices, indicating a shift in demand and supply dynamics, although that may be temporary. The decline may offer opportunities for potential buyers to enter the market at a more favorable price point.”

Year-to-date, there have been 5,217 condo sales, a 26.6 percent decrease from the first four months of 2022 with a median sale price of $490,000, a 4.3 percent increase on the same basis.

MA Median Single-Family Home Price Reaches $610,000 in June

Median condo price remains above $500,000 for the third consecutive month.

PEABODY, July 19, 2022 – The median sale price for single-family homes reached $610,000 in June, the first time the median sale price has exceeded $600,000 since record-keeping began in 1987, according to a new report from The Warren Group, a leading provider of real estate and

transaction data.

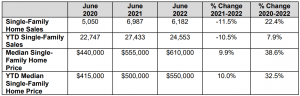

Single-Family Homes

Last month, there were 6,182 single-family home sales in Massachusetts, an 11.5 percent decrease from June 2021 when there were 6,987 transactions. Meanwhile, the median single-family sale price spiked 9.9 percent on a year-over-year basis to $610,000, up from $555,000 in June 2021 – a new all-time high for single-family homes since The Warren Group started tracking sales activity in 1987.

“This is the first time that the Massachusetts median single-family home price has ever exceeded the $600,000 mark. Keep in mind that it was only 14 months ago when the median price of $500,000 was exceeded for the first time. I doubt we’ve seen the end of it,” said Tim Warren, CEO of The Warren Group. “Experts keep speculating that with the recent hike in interest rates that prices could plateau in the near future, but I’m not sure we’re at the tipping point just yet. Price increases are moderating this year, but they are far from flatlining. There are just so many buyers and not enough homes to go around. I expect prospective buyers to continue paying significant premiums in the coming months, even as it gets more expensive to borrow money.”

Year-to-date, there have been 24,553 single-family home sales in Massachusetts, a 10.5 percent decrease from the first six months of 2021. Meanwhile, the year-to-date median single-family home price increased 10 percent on the same basis to $550,000.

Condominiums

There were 2,748 condominium sales in June 2022, compared to 3,189 in June 2021 – a 13.8 percent decrease on a year-over-year basis. Meanwhile, the median sale price increased 10.2 percent on a year-over-year basis to $539,000 – the third consecutive month that the median condo price has hovered above $500,000.

“Historically, condos have been a more affordable alternative for homeownership in Massachusetts,” Warren added. “Even though the median sale price of $539,000 is significantly lower than the median single-family home price of $610,000, it’s still prohibitively expensive for many buyers, especially as purchasing power declines due to rising mortgage rates.”

Year-to-date, there have been 12,264 condo sales, an 11.6 percent decrease from the first six months of 2021 with a median sale price of $499,000, an 8.5 percent increase on the same basis.

MA Median Single-Family Home Price Sets Another All-Time High in May Median condo price remains above $500,000 for the second consecutive month.

PEABODY, June 21, 2022 – The median sale price for both single-family homes and condominiums continued to set records in May, as limited inventory and fierce competition

continued to add upward pressure to prices, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Single-Family Homes

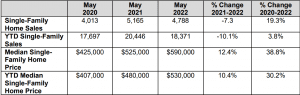

Last month, there were 4,788 single-family home sales in Massachusetts, a 7.3 percent decrease from May 2021 when there were 5,165 transactions. Meanwhile, the median single-family sale price increased 12.4 percent on a year-over-year basis to $590,000, up from$525,000 in May 2021 – a new all-time high for single-family homes since The Warren Group started tracking sales in 1987.

“I might sound like a bit of a broken record announcing that the median single-family home price reached yet another new all-time high, but it’s truly indicative of current market conditions,” said Tim Warren, CEO of The Warren Group. “The balance between supply and demand has been way out of sync for some time, and this is the manifestation of that imbalance. To cope, many buyers are setting their sights on markets further and further from major hubs – and even outside of Massachusetts.”

Year-to-date, there have been 18,371 single-family home sales in Massachusetts, a 10.1 percent decrease from the first five months of 2021. Meanwhile, the year-to-date median single-family home price increased 10.4 percent on the same basis to $530,000.

Condominiums

There were 2,414 condominium sales in May 2022, compared to 2,730 in May 2021 – an 11.6 percent decrease on a year-over-year basis. Meanwhile, the median sale price increased 7.1 percent on a year-over-year basis to $525,000 – the second consecutive month that the median condo price has hovered above $500,000

“The median condo price has now been above $500,000 for two straight months, and the median price of $525,000 marked a new all-time high for the month of May,” Warren continued. “It’s apparent that demand for condos is strong, which may make it difficult for prospective homebuyers who are looking at condos as an alternative to single-family homes.”

Year-to-date, there have been 9,516 condo sales, an 11 percent decrease from the first five months of 2021 with a median sale price of $482,500, a 7.2 percent increase on the same basis.

MA Median Single-Family Home & Condo Prices Reach Record Highs in April Median condo price surpasses $500,000 for the first time since record-keeping began.

PEABODY, May 17, 2022 – Limited inventory and competition among buyers continued to drive housing activity across Massachusetts in April, pushing the median sale prices of both single-family homes and condos to new highs, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Single-Family Homes

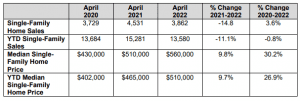

Last month, there were 3,862 single-family home sales in Massachusetts, a 14.8 percent decrease from April 2021 when there were 4,531 transactions. Meanwhile, the median single-family sale price increased 9.8 percent on a year-over-year basis to $560,000, up from $510,000 in April 2021 – a new all-time high for single-family homes

“The median single-family home price of $560,000 marked a new all-time high for Massachusetts,” said Tim Warren, CEO of The Warren Group. “Under normal conditions, this

would be a reason to celebrate, but only if you currently own a home and you’re looking to sell and don’t need to buy a new home. With such limited inventory – not only across Massachusetts but also across the country – finding that next place to live will prove to be challenging. Meanwhile, as interest rates continue to increase, buyers will continue to expand their searches to more rural communities – adding even more competition in markets that have

historically been more affordable.”

Year-to-date, there have been 13,580 single-family home sales in Massachusetts, an 11.1 percent decrease from the first four months of 2021. Meanwhile, the year-to-date median single-family home price increased 9.7 percent on the same basis to $510,000.

Condominiums

There were 2,149 condominium sales in April 2022, compared to 2,534 in April 2021 – a 15.2 percent decrease on a year-over-year basis. Meanwhile, the median sale price increased 11.6 percent on a year-over-year basis to $530,000 – a new all-time high for condos.

“The median condo price took off like a rocket in April,” Warren continued. “The double-digit increase on a year-over-year basis to $530,000 marked a new all-time high for condos. Meanwhile, the median condo price increased by more than 25 percent when compared to April 2020. As the spring and summer housing markets continue to heat up, it will be interesting to see where prices go from here.”

Year-to-date, there have been 4,490 condo sales, a 17.2 percent decrease from the first three months of 2021 with a median sale price of $450,000, a 5.9 percent increase on the same basis.

Massachusetts Median Single-Family Home Price Remains Above $500,000 For Second Consecutive Month

Condo sales continue to rebound in May as life in urban centers returns to normal. PEABODY, June 16, 2021 – Fierce demand among buyers in May continued to push median single-family home and condo prices to new highs, according to a new report from The Warren Group, a leading provider of real estate and transaction data. Single-family home and condo sales declined significantly during the second quarter of 2020 as a result of economic uncertainties surrounding COVID-19. In order to give a more accurate representation of activity in the Massachusetts real estate market, we are providing two years of data as a comparison in

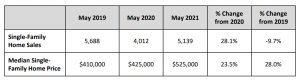

this month’s sales report. Single-Family Homes Last month, there were 5,139 single-family home sales in Massachusetts, 28.1 percent increase from May 2020 when there were just 4,012 transactions. Compared to May 2019 (5,688 transactions), single-family home sales declined 9.7 percent. In May 2021, the median single-family sale price spiked 23.5 percent on a year-over-year basis to $525,000, up from $425,000 in May 2020 and up 28 percent from May 2019 when the median sale price was $410,000. This marked the second consecutive month that the median single-family home price has surpassed $500,000.  “Once again – because of significant disruption to the housing market caused by COVID-19 and the subsequent lockdown – it would be disingenuous to analyze our sales data on a year-over-year basis,” said Tim Warren, CEO of The Warren Group. “So, let’s look at where Massachusetts housing was at two years ago for a more accurate comparison. You might think that the most interesting data point is that

“Once again – because of significant disruption to the housing market caused by COVID-19 and the subsequent lockdown – it would be disingenuous to analyze our sales data on a year-over-year basis,” said Tim Warren, CEO of The Warren Group. “So, let’s look at where Massachusetts housing was at two years ago for a more accurate comparison. You might think that the most interesting data point is that

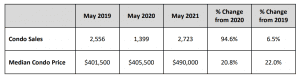

statewide, the median price is up more than $115,000 on a two-year basis, but what I’m more interested in is that sales dipped almost 10 percent from May two years ago. I’ve been saying for quite a while that it’s only a matter of time before demand wouldn’t be able to keep up with supply, and this could be the first time we have a concrete data point indicating its coming to fruition. As inventory continues to dwindle, we’ll continue to see declining sales and inflated prices in the coming months.” Year-to-date, there have been 20,403 single-family home sales in Massachusetts, a 15.3 percent increase from the first five months of 2020. Meanwhile, the year-to-date median single family home price increased 17.9 percent on the same basis to $480,000. Condominiums There were 2,723 condominium sales in May, a 94.6 percent increase from May 2020 when there were 1,399 condo sales. Compared to May 2019 (2,556 transactions), condo sales were up a more modest 6.5 percent. Meanwhile, the median sale price increased 20.8 percent on a year-over-year basis to $490,000 – a new all-time high. This also marked the tenth consecutive month that the median condo price has

been more than $400,000. Compared to May 2019 ($401,500), the median condo price was up 22 percent.  “Condos continued to rebound in May as life in urban centers continued to get back to normal,” Warren continued. “If activity in the condo market continues at this clip, I fully expect the median sale price of both single-family homes and condos to surpass $500,000 in the coming months, which would be a first.” Year-to-date, there have been 10,682 condo sales, a 39.7 percent increase from the first five months of

“Condos continued to rebound in May as life in urban centers continued to get back to normal,” Warren continued. “If activity in the condo market continues at this clip, I fully expect the median sale price of both single-family homes and condos to surpass $500,000 in the coming months, which would be a first.” Year-to-date, there have been 10,682 condo sales, a 39.7 percent increase from the first five months of

2020 with a median sale price of $450,000, an 8.4 percent increase on the same basis. LOCAL STATISTICS: Click for breakdown of town sales and county sales statistics. ————————————————————————————————————————————————————–

————————————————————————————————————————————————————–

————————————————————————————————————————————————————–

————————————————————————————————————————————————————– This is GREA news for anyone who looking to buy a CONDO in non-FHA-approved communities. Opening up the pool of buyers with FHA loans on an individual unit basis is a game changer. So excited! Read below… Message me if you want to start looking for your new condo home!

————————————————————————————————————————————————————– This is GREA news for anyone who looking to buy a CONDO in non-FHA-approved communities. Opening up the pool of buyers with FHA loans on an individual unit basis is a game changer. So excited! Read below… Message me if you want to start looking for your new condo home!

HUD to Announce Long-Awaited FHA Condo Rules

The U.S. Department of Housing and Urban Development is expected to release updated guidance tomorrow on FHA-insured condominium financing. The new rules should benefit your real estate clients and customers by allowing more buyers to obtain low down-payment mortgages on affordable housing options. Specifically, the new rules will: • Extend FHA certifications on condo developments from two years to three years, reducing the compliance burden on condo boards. • Allow for single-unit mortgage approvals-often known as spot approvals-which will enable FHA insurance of individual condo units, even if the property does not have FHA approval. • Secure additional flexibility in the ratio of investors to owner-occupants allowed for FHA financing in a condo building. The full guidance will go into effect in mid-October, 60 days from publication. “Condominiums are often the most affordable option for first time home buyers, small families, and those in urban areas,” said NAR President John Smaby, in a statement issued to the media Wednesday morning. “We are thrilled that (HUD) Secretary (Ben) Carson has taken this much-needed step to put the American dream within reach for thousands of additional families.” Since 2008, NAR has championed policy changes in condo lending. NAR has sought rules that would allow the owner-occupancy level to be determined on a case-by-case basis and that would extend the approval period for project certification to five years. NAR’s existing-home sales report for June showed condominium and co-op sales at a seasonally adjusted annual rate of 580,000 units, a decline of 3.3% from May and 6.5% from June 2018. With more than 8.7 million condo units nationwide, only 17,792 FHA condo loans have been originated in the past year. “This ruling, which culminates years of collaboration between HUD and NAR, will help reverse recent declines in condo sales and ensure the FHA is fulfilling its primary mission to the American people,” Smaby said. The full rule for single-family condo financing is scheduled to be published in the Federal Register on Aug. 15, 2019, and available online at https://federalregister.gov/d/2019-17213, and on govinfo.gov.

In 5 Major Markets, Foreclosure Starts Tick Up

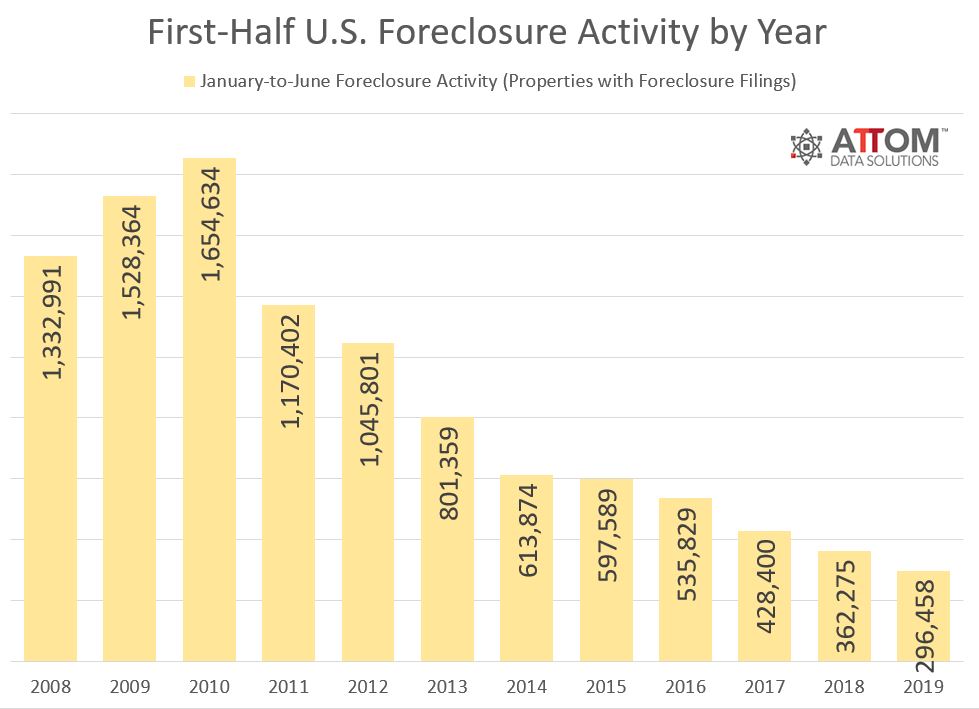

In the first half of 2010, foreclosures peaked at 1.6 million-plus properties. In the recovery since, foreclosures have plummeted 82 percent, according to a new report.

Credit: ATTOM Data Solutions

Credit: ATTOM Data Solutions

In the first half of 2019, foreclosures hung on over 295,000 properties, according to ATTOM Data Solutions findings, released today-an 18-percent drop from last year. Approximately 177,000 began the foreclosure process in that time, defined as “foreclosure starts,” falling 8 percent year-over-year.

At odds with the overall trend, foreclosures increased in 16 percent of the largest markets in the U.S., with Buffalo, N.Y., and four Florida markets seeing spikes: Jacksonville, Miami, Orlando and Tampa-St. Petersburg.

Notably, Jacksonville also claimed a considerable foreclosure rate, at 0.54 percent of properties. The highest? New Jersey, with foreclosures on 0.54 percent of properties statewide, and home to two major markets in similar straits: Atlantic City, with a foreclosure rate of 0.92 percent; and Trenton, at 0.52 percent.

Across 16 states-and in 42 percent of the largest markets-foreclosure initiations picked up, concentrated in Southern states. In Mississippi, foreclosure starts surged 56 percent year-over-year, and in Florida, rose 28 percent.

“Our midyear 2019 foreclosure activity helps to show an overall view on how foreclosure activity is trending downward,” says Todd Teta, ATTOM Data Solutions chief product officer. “Of course, you still have pockets across the nation where foreclosure activity is seeing some flare-ups.”

Are the blips cause for concern? According to Teta, as prices remain on the rise, foreclosure starts warrant watching.

“Foreclosure starts is a good indication of markets to watch,” Teta says. “Affordability definitely plays a factor in why some areas across the nation are seeing an uptick in foreclosure starts. The fact that median home sales prices are reaching new levels in Q2 2019, mortgage rates are remaining low and job growth is still strong, lenders are becoming more aggressive with their payment collection because they are confident in getting a decent return in this hot housing market.”

Foreclosure Increases – Markets to Watch

1. Buffalo, N.Y. (+33%) 2. Orlando, Fla. (+32%) 3. Jacksonville, Fla. (+18%) 4. Miami, Fla. (+7%) 5. Tampa-St. Petersburg, Fla. (+5%)

Foreclosure Starts – Markets to Watch

1. Miami, Fla. (+32%)

2. Tampa-St. Petersburg, Fla. (+18%)

3. Atlanta, Ga. (+16%)

4. Washington, D.C. (+8%)

5. Denver, Colo. (+6%)

Foreclosure Rates (Metro)

1. Atlantic City, N.J. (0.92%)

2. Jacksonville, Fla. (0.54%)

3. Trenton, N.J. (0.52%)

4. Rockford, Ill. (0.51%)

5. Lakeland, Fla. (0.51%)

6. Columbia, S.C. (0.49%)

7. Ocala, Fla. (0.49%)

8. Philadelphia, Pa. (0.48%)

9. Fayetteville, N.C. (0.47%)

10. Baltimore, Md. (0.44%)

Foreclosure Rates (State)

1. New Jersey (0.54%)

2. Delaware (0.46%)

3. Maryland (0.43%)

4. Florida (0.39%)

5. Illinois (0.38%)

6. South Carolina (0.33%)

7. Connecticut (0.32%)

8. Ohio (0.3%)

9. Nevada (0.26%)

10. New Mexico (0.26%)

For the complete findings from the report, please visit www.ATTOMData.com.

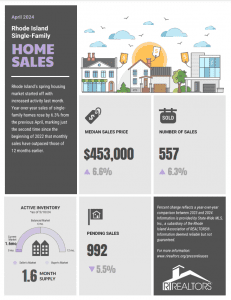

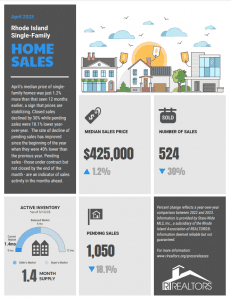

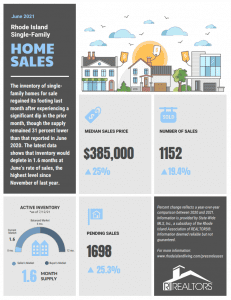

R.I. Single-family Home Sales Continue to Rise in Second Quarter

Warwick, R.I. – August 1, 2019 — The Rhode Island Association of Realtors released second-quarter sales statistics today from State-Wide Multiple Listing Service, an association subsidiary which tracks all Realtor-assisted sales. The data portrayed a Rhode Island housing market that continued to gain momentum from the previous year. The number of existing single-family home sales increased 2.6 percent in the second quarter, compared to the same time period in 2018. The median price of those sales rose 4.3 percent to $292,000.

“Despite still struggling with a low supply of homes for sale, Rhode Island’s housing market is moving along. A good economy and continued low interest rates have done a lot to keep the market active,” said Dean deTonnancourt, 2019 President of the Rhode Island Association of Realtors.

Twenty-seven out of the 40 Rhode Island areas reported showed a year-over-year increase in the median sales price of single-family homes in the second quarter. Little Compton, Portsmouth and East Greenwich saw the biggest gains — 36.1, 17.7 and 15.1 percent respectively. Median sales price, the midpoint of sales with half selling for more and half selling for less, generally reflects the type and size of the properties sold at the time and is not representative of home appreciation or depreciation among all homes in the area.

Condominium sales followed the same trends. Closings increased by 4.3 percent while the median sales price rose by 3.6 percent to $232,000.

Only the multifamily home market showed a lull in activity. Sales fell by 12 percent last quarter while median price rose by 9.6 percent to $263,000.

Federal Reserve Announces Rate Cut

August 1, 2019 Yesterday, the U.S. Federal Reserve announced it would cut interest rates 25 basis points, the first cut since 2008. Lawrence Yun, chief economist for the National Association of REALTORS®, believes that since the rate cut was anticipated, it will have little effect on 30-year mortgage rates though adjustable rate mortgages could be favorably affected.

MA Median Single-Family Home, Condo Prices Reach New Highs in June

Sales activity falls during record-setting monthPEABODY, July 24, 2019 – The median sale price for both single-family homes and condominiums continued their upward climb in June, reaching new highs in the process, according to a new report from The Warren Group, publisher of Banker & Tradesman.Last month, there were 6,523 single-family home sales recorded in Massachusetts, a 9.6 percent decrease from June 2018 when there were 7,217 transactions. Meanwhile, the median single-family sale price rose 2.1 percent on a year-over-year basis to $429,000, which marked an all-time high for single-family homes. Year-to-date, there have been 26,226 single-family home sales – a 1.1 percent decrease from the first six months of 2018 – with a median sale price of $395,000 – a 3.9 percent increase on the same basis.”The lack of supply in the Massachusetts housing market and its impact on prices has never been more evident,” said Tim Warren, CEO of The Warren Group. “Last month, I observed that a lack of new listings on the market would continue to add upward pressure to single-family home prices. This appears to have played out and could continue to do so during the remainder of the summer.”Concurrently, there were 5,918 purchase mortgages for single-family homes in June, marking a 7.8 percent decrease on a year-over-year basis. June purchase mortgages totaled $2.48 billion – a 6.5 percent decrease from a year earlier. Year-to-date, single-family homes have accounted for 23,628 purchase mortgages across Massachusetts totaling $9.47 billion.

Median single-family home sale price reaches all-time high for month of April 2019

Single-family home and condominium sales increased last month as the spring Massachusetts real estate market started to heat up, according to a new report from The Warren Group, publisher of Banker & Tradesman.

Last month, there were 4,279 single-family home sales recorded in Massachusetts, a 2.8 % increase from April 2018 when there were 4,162 transactions.

Meanwhile, the median single-family sale price rose 2 % on a year-over-year basis to $382,500, which marked an all-time high for the month of April. Year-to-date, there have been 14,004 single-family home sales with a median sale price of $375,000 – a 5 percent increase from the first four months of 2018.

“The median sale price for single-family homes has been steadily on the rise for the last three years,” said The Warren Group Associate Publisher and Media Relations Director Cassidy Norton. “Even with inventory levels improving, I fully expect stiff competition between buyers to keep prices elevated during the upcoming spring and summer months.”

Concurrently, there were 3,823 purchase mortgages for single-family homes in April, marking a 5.2 percent increase on a year-over-year basis. April purchase mortgages totaled $1.52 billion – a 6 percent increase from a year earlier. Year-to-date, single-family homes have accounted for 12,581 purchase mortgages across Massachusetts totaling $8.87 billion.

***************Looking to Buy or Sell in MA or RI, please contact stacycorrigan@pompmre.com*******************

Inventory increased and metro market prices rose in the first quarter of 2019, but at a slower pace than the previous quarter, according to new research.

From the first quarter of 2018 to the first quarter of 2019, home prices rose 3.9 percent, according to a National Association of REALTORS® (NAR) report. On an annual basis, there were higher home prices in 86 percent, or 153 of the 178 metropolitan areas in the report. Comparing the largest markets, the median price was $254,800, up from $245,300 in Q1 2018.

Thirteen metro areas (7 percent) experienced double-digit increases, down from 14 in 2018’s first quarter.

Lawrence Yun, NAR chief economist, says the first quarter has been beneficial to U.S. homeowners. “Homeowners in the majority of markets are continuing to enjoy price gains, albeit at a slower rate of growth. A typical homeowner accumulated $9,500 in wealth over the past year,” he said.

A look at the affordability factor: According to the report, national family median income rose to $77,752 in the first quarter, while higher home prices caused overall affordability to decrease from last year. So a buyer making a 5% down payment would need an income of $60,143 to purchase a single-family home at the national median price, while a 10% down payment would require an income of $56,978, and $50,647 would be necessary for a 20% down payment.

According to the report, existing-home sales, including single family homes and condos, increased 1.2 percent from the last quarter and 5.4 percent from the prior year. At the close of the first quarter of 2019, existing for-sale inventory totaled 1.64 million-2.4 percent higher than the prior year. During the first quarter, the average supply was 3.8 months-up from 3.5 months in the first quarter of 2018.

Northeast

Q1 Existing-Home Sales: -1.0% YoY

Q1 Median Price: $277,200 (+3.7% YoY)

“There are vast home price differences among metro markets,” Yun says. “The condition of extremely high home prices may not be sustainable in light of many alternative metro markets that are much more affordable. Therefore, a shift in job search and residential relocations into more affordable regions of the country is likely in the future.”

Yun continues to call on the construction industry to develop more affordable housing units, which he says will combat slower price gains and buyer pullback. “More supply is needed to provide better homeownership opportunities, taming home price growth and widening the inventory choices for consumers. Housing Opportunity Zones could provide the necessary financial benefits for homebuilders to construct moderately priced-homes,” Yun said.