MA Single-Family Home, Condo Sales Decline; Price Increases Continue at a Slower Pace

Single-family home sales down 16.2 percent on a year-over-year basis.

PEABODY, October 18, 2022 – Single-family home and condo sales declined across Massachusetts in September as mortgage rates rise, inventory remains in short supply, and consumer prices climb, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

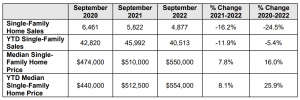

Single-Family Homes

Last month, there were 4,877 single-family home sales in Massachusetts, a 16.2 percent decrease from September 2021 when there were 5,822 transactions. This marked the 15th consecutive month that single-family home sales have declined on a year-over-year basis. Meanwhile, the median single-family sale price increased 7.8 percent on a year-over-year basis to $550,000, up from $510,000 in September 2021 – a new all-time high for the month of September.

“Single-family sales numbers took another hit in September as limited inventory, economic uncertainties, and rising interest rates continued to weigh heavily on prospective buyers,” said Tim Warren, CEO of The Warren Group. “In fact, this was the fewest number of single-family sales that we’ve seen in the month of September since 2014. The median sale price is showing a slowdown as well. Prices are still rising, but at a more moderate pace. Last year there were only three months in which prices failed to increase by double digits. This year, through September, the price increase has been in single digits for 6 months. The big question is whether we will see the median price decline in a future month.”

Year-to-date, there have been 40,513 single-family home sales in Massachusetts, an 11.9 percent decrease from the first nine months of 2021. Meanwhile, the year-to-date median single-family home price increased 8.1 percent on the same basis to $554,000.

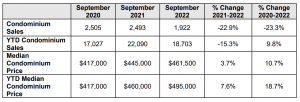

Condominiums

There were 1,922 condominium sales in September 2022, compared to 2,471 in September 2021 – a 22.9 percent decrease on a year-over-year basis. This marked the 13th consecutive month that condo sales have declined on a year-over-year basis. Meanwhile, the median sale price increased 3.7 percent on a year-over-year basis to $461,500 – a new all-time high for the month of September.

“The condo market has underperformed the single-family market in recent months, showing larger sales declines than single-family homes in every month this year,” Warren added. Year-to-date, there have been 18,703 condo sales, a 15.3 percent decrease from the first nine months of 2021 with a median sale price of $495,000, a 7.6 percent increase on the same basis.

MA Single-Family Home, Condo Sales Continue to Decline in August

Median single-family home price increases 5.6 percent year-over-year to $565,000.

PEABODY, September 20, 2022 – The sales volume of Massachusetts single-family home and condominium sales continued to decline in August on a year-over-year basis, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

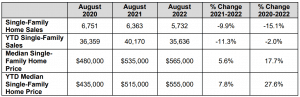

Single-Family Homes

Last month, there were 5,732 single-family home sales in Massachusetts, a 9.9 percent decrease from August 2021 when there were 6,363 transactions. Meanwhile, the median single-family sale price increased 5.6 percent on a year-over-year basis to $565,000, up from $535,000 in August 2021 – a new all-time high for the month of August.

“This is the first time the median condo price dipped below $500,000 in five months and the pace of increase in median price is slowing dramatically,” Warren added. “This is likely the result of rising interest rates making it much more expensive to borrow money and prospective buyers unwilling to saddle themselves with exorbitant monthly payments.” Year-to-date, there have been 16,782 condo sales, a 14.4 percent decrease from the first eight months of 2021 with a median sale price of $500,000, an 8.2 percent increase on the same basis.

Year-to-date, there have been 35,636 single-family home sales in Massachusetts, an 11.3 percent decrease from the first eight months of 2021. Meanwhile, the year-to-date median single-family home price increased 7.8 percent on the same basis to $555,000.

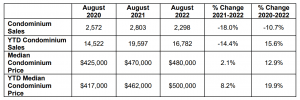

Condominiums

There were 2,298 condominium sales in August 2022, compared to 2,803 in August 2021 – an 18.0 percent decrease on a year-over-year basis. Meanwhile, the median sale price increased 2.1 percent on a year-over-year basis to $480,000 – a new all-time high for the month of August.

“This is the first time the median condo price dipped below $500,000 in five months and the pace of increase in median price is slowing dramatically,” Warren added. “This is likely the result of rising interest rates making it much more expensive to borrow money and prospective buyers unwilling to saddle themselves with exorbitant monthly payments.”

Year-to-date, there have been 16,782 condo sales, a 14.4 percent decrease from the first eight months of 2021 with a median sale price of $500,000, an 8.2 percent increase on the same basis.

MA Single-Family Home, Condo Sales Continue to Plummet in July Median single-family home price increases 8.3 percent year-over-year to $585,000.

PEABODY, August 16, 2022 – Single-family home and condominium sales declined dramatically in July. The market has cooled in Massachusetts after being confronted with high prices and rising mortgage rates, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

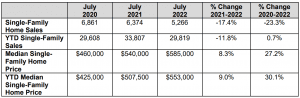

Single-Family Homes

Last month, there were 5,266 single-family home sales in Massachusetts, a 17.4 percent decrease from July 2021 when there were 6,374 transactions. Meanwhile, the median single-family sale price spiked 8.3 percent on a year-over-year basis to $585,000, up from $540,000 in July 2021 – a new all-time high for the month of July.

“Mortgage rates are now over five percent while a year ago they were under three percent. The single-family home median price is $45,000 higher than a year ago. Increases in wages and salaries are not keeping pace with inflation that is now running at 8.5 percent. Plus, homebuyers face a very low inventory of homes for sale. All this leads us to a cooler real estate market,” said Tim Warren, CEO of The Warren Group. “We’ve seen the same trend occur for many consecutive months now; prices reach new highs while the total number of sales declines on a year-over-year basis. Evidence in the cooling is seen in prices. They are rising at a slower rate, gaining just 9 percent so far this year after gaining 14 percent last year.”

Year-to-date, there have been 29,819 single-family home sales in Massachusetts, an 11.8 percent decrease from the first seven months of 2021. Meanwhile, the year-to-date median single-family home price increased 9 percent on the same basis to $553,000.

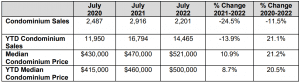

Condominiums

There were 2,201 condominium sales in July 2022, compared to 2,916 in July 2021 – a 24.5 percent decrease on a year-over-year basis. Meanwhile, the median sale price increased 10.9 percent on a year-over-year basis to $521,000 – the fourth consecutive month that the median condo price has hovered above $500,000.

“The median condo price has now been above $500,000 for four consecutive months, and $521,000 marked a new all-time high for the month of July,” Warren added. “The median condo price is up 10.9 percent in July, outpacing the 8.3 percent gain in the single-family median price.”

Year-to-date, there have been 14,465 condo sales, a 13.9 percent decrease from the first seven months of 2021 with a median sale price of $500,000, an 8.7 percent increase on the same basis.

Massachusetts Single-Family Home, Condo Sales Drop for Third Consecutive Month in June as COVID-19 Continues to Impact Market

Median condo price sees its first year-over-year decline since April 2019.

PEABODY, July 22, 2020 – As COVID-19 continues to impact the local housing market, both single-family home and condominium sales declined by double digits in June, according to a new report from The Warren Group, a leading provider of real estate and transaction data.

Last month, there were 5,004 single-family home sales in Massachusetts, a 23.4 percent decrease from June 2019 when there were 6,530 transactions. This marked the fewest number of single-family home sales in the month of June since 2011, when there were 4,471 transactions. Meanwhile, the median single-family sale price increased 2.6 percent on a year-over-year basis to $440,000, up from $429,000 in June 2019 – an all-time high for the month of June. Year-to-date, there have been 22,662 single-family home sales – a 13.7 percent decrease from the first six months of 2019 – with a median sale price of $415,000 – a 5.1 percent increase on the same basis.

“Even though single-family home sales saw a significant decline in June, it’s not due to a lack of demand,” said Tim Warren, CEO of The Warren Group. “The statewide inventory has steadily declined for years on end and COVID-19 has given homeowners new reasons to stay put for now. There seem to be plenty of buyers looking for homes and the median price has climbed every month for 51 straight months.”

There were 1,815 condominium sales in June, compared to 2,620 sales in June 2019 – a 30.7 percent decrease. Meanwhile, the median sale price fell 5.7 percent on a year-over-year basis to $396,000, down from $420,000 in June 2019. Year-to-date, there have been 9,463 condo sales – a 16.7 percent decrease from the first six months of 2019 – with a median sale price of $410,000 – a 7.9 percent increase on the same basis.

“The median condo price took its first year-over-year dip in 14 months,” Warren added. “Prior to this development, the median sale price exceeded $400,000 for four consecutive months and was actually on track to outpace the median single-family home price during the course of 2020. It seems like potential condo buyers are waiting to see how the pandemic progresses before they commit to urban living and elevator ride

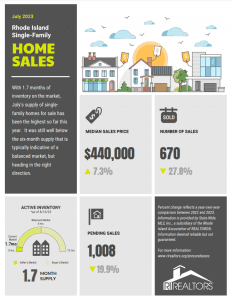

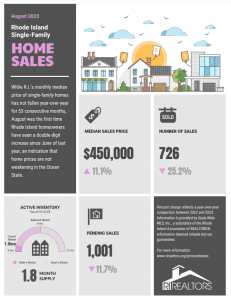

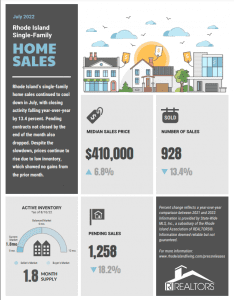

Low supply continues in RI housing market

Warwick, RI – September 19, 2019 – Low inventory continues to perpetuate rising home prices in Rhode Island according to August data released today by the Rhode Island Association of Realtors. The median price of single-family homes sold last month rose 7.2 percent to $295,000, compared to August of 2018. The median sales price of condominiums sold in Rhode Island in August rose 15.8 percent year-over-year and the median price of multifamily properties rose ten percent.

Inventory in all three sectors remains markedly low – hovering near a four-month supply for single-family homes and condominiums and a 3.5-month supply for multifamily properties. A six-month supply is considered a healthy balance between supply and demand by most industry experts.

Sales activity saw a jump in the condominium market last month, rising 13.7 percent from 12 months earlier but sales slowed in the single-family home and condo markets. Given the scarcity of single-family starter homes, condominiums have become an attractive option for first-time buyers.

Also, in August, the U.S. Department of Housing and Urban Development released updated guidance on FHA-insured condominium financing. The new rules, which are set to take effect in mid-October, should make it easier for more buyers to obtain low down-payment mortgages for condo purchases by eliminating financing barriers to that sector of the market.

“Overall, as our economy moves along, so too does our housing market. The only thing hindering us right now is the lack of properties available on the market. Regardless of what happens to interest rates over the next year, we can’t sell what we don’t have available for sale.

Low supply continues in RI housing market

Warwick, RI – September 19, 2019 – Low inventory continues to perpetuate rising home prices in Rhode Island according to August data released today by the Rhode Island Association of Realtors. The median price of single-family homes sold last month rose 7.2 percent to $295,000, compared to August of 2018. The median sales price of condominiums sold in Rhode Island in August rose 15.8 percent year-over-year and the median price of multifamily properties rose ten percent.

Inventory in all three sectors remains markedly low – hovering near a four-month supply for single-family homes and condominiums and a 3.5-month supply for multifamily properties. A six-month supply is considered a healthy balance between supply and demand by most industry experts.

Sales activity saw a jump in the condominium market last month, rising 13.7 percent from 12 months earlier but sales slowed in the single-family home and condo markets. Given the scarcity of single-family starter homes, condominiums have become an attractive option for first-time buyers.

Also, in August, the U.S. Department of Housing and Urban Development released updated guidance on FHA-insured condominium financing. The new rules, which are set to take effect in mid-October, should make it easier for more buyers to obtain low down-payment mortgages for condo purchases by eliminating financing barriers to that sector of the market.

“Overall, as our economy moves along, so too does our housing market. The only thing hindering us right now is the lack of properties available on the market. Regardless of what happens to interest rates over the next year, we can’t sell what we don’t have available for sale.

“If there’s anyone thinking about selling, now’s the time. The conditions to maximize your investment don’t get much better than this,” commented Dean deTonnancourt, 2019 President of the Rhode Island Association of Realtors.

MA Median Single-Family Home Price Exceeds $400,000 for Fourth Consecutive Month

Median condominium sale price spikes nearly 10 percent on year-over-year basis

PEABODY, September 25, 2019 – The median sale price for both single-family homes and condominiums continued to rise in August on a year-over-year basis despite modest declines in the number of sales, according to a new report from The Warren Group, publisher of Banker & Tradesman.

Last month, there were 6,606 single-family home sales recorded in Massachusetts, a 3.1 percent decrease from August 2018 when there were 6,818 transactions. Nevertheless, the median single-family sale price rose 4.7 percent on a year-over-year basis to $420,000, which marked an all-time high for the month of August. Year-to-date, there have been 39,259 single-family home sales – a 2 percent decrease from the first eight months of 2018 – with a median sale price of $402,000 – a 3.1 percent increase on the same basis.

“The median single-family home price continued to break records during the last full month of closings for the summer,” said Tim Warren, CEO of The Warren Group. “Sales were down in August for the third consecutive month. This year marks the third consecutive year of modest declines in home sales. Everyone is trying to figure out if this is a sign of a slowing market or simply a lack of inventory. I’m betting on a strong local economy and job growth to keep housing hot for another year.”

Concurrently, there were 5,958 purchase mortgages for single-family homes in August, marking a 3.2 percent decrease on a year-over-year basis. August purchase mortgages totaled $2.45 billion – a 0.1 percent decrease from a year earlier. Year-to-date, single-family homes have accounted for 35,422 purchase mortgages across Massachusetts totaling $14.39 billion.

In August, there were 2,609 condominiums sales, compared to 2,618 sales in August 2018 – a 0.3 percent decrease. Meanwhile, the median sale price spiked 9.9 percent to $401,000 – an all-time-high for the month of August. Year-to-date, there have been 16,440 condo sales – a 3.2 percent decrease – with a median sale price of $385,000 – a 2.7 percent increase from the first eight months of 2018.

“The August median condo price experienced the largest year-over-year gain seen so far in 2019,” Warren continued. “August marked the third month this year that the median condo price exceeded $400,000. With new developments planned and under construction in the greater Boston area, the statewide condo market may continue to set new records in the near future.”

Condos accounted for 1,927 purchase mortgages last month, totaling $721 million. Year-to-date, condos have accounted for 12,409 purchase mortgages totaling $4.64 billion.